Mileage Log Form Driver For Mac

My Mileage is a simple and easy to use app to track your mileage and expenses.It’s a great helper for both business and personal use.With My Mileage, you can track your expenses, start and end time, odometer, start and destination, usage, purpose, vehicle and driver etc. More than that, you can use GPS to track path of your trip.My Mileage will calculate the deduction and total expenses of your trips.

Learn why it is important to use a mileage tracker app for any business-related trips. Use the QuickBooks mileage tracker to make logging your kilometres with the Canadian Revenue Agency (CRA) easy.

If you use your vehicle to earn income, the Canada Revenue Agency (CRA) lets you claim a business tax deduction based on your mileage. To ensure you claim the correct amount, you need to track the number of kilometres you drive for both personal and business purposes. Ideally, you should use a mileage log book or mileage tracker app like QuickBooks Self-Employed.

What Is a Mileage Log?

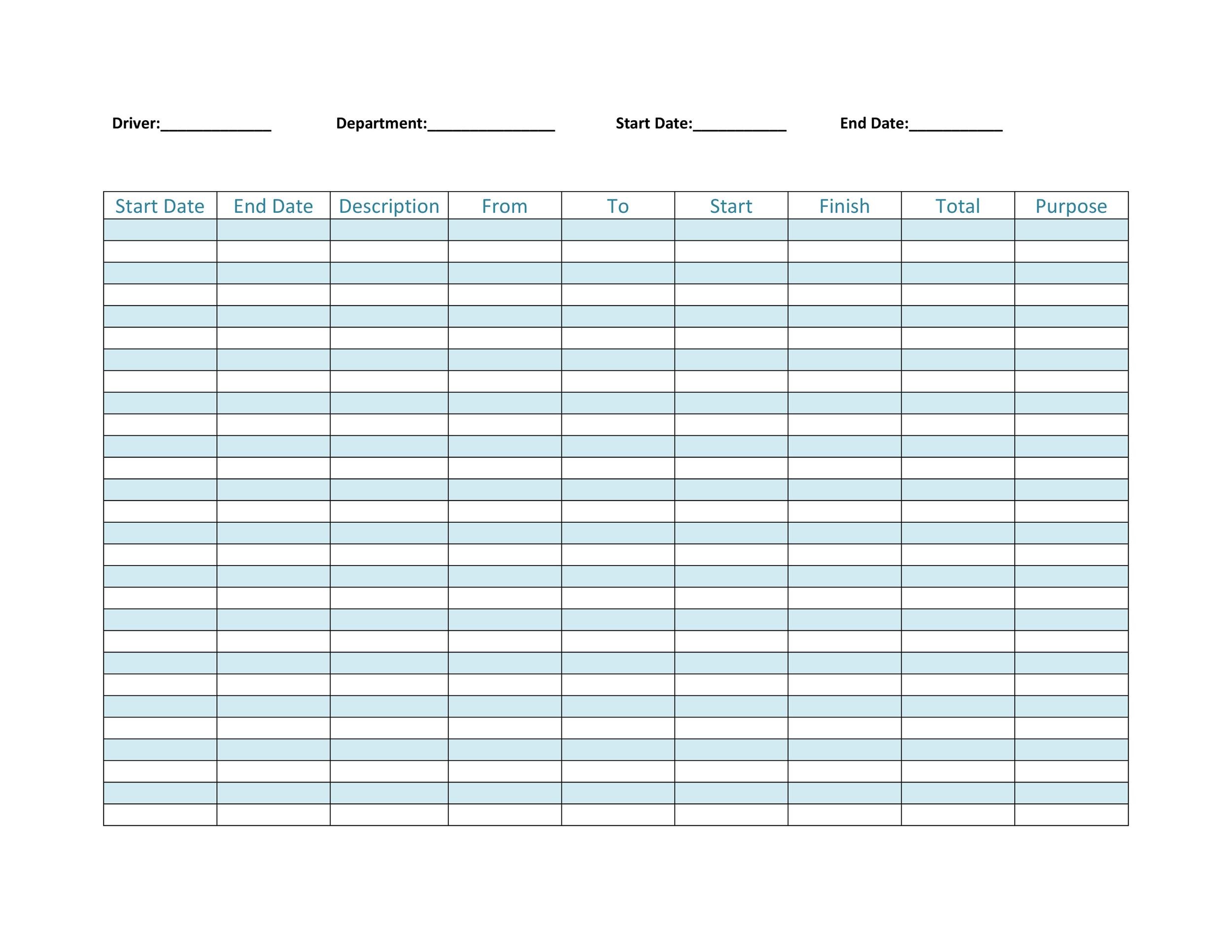

Also called a logbook, a mileage log is a record of all your business travel. Every entry should detail the date, purpose of the journey, destination, and distance covered. You should also note your odometer reading at the beginning and end of the year.

Once you have your total mileage for the year and a logbook detailing your business trips, you can easily calculate which percentage of your vehicle use was for work.

For example, say the odometer reading was 10,000 kilometres at the beginning of the year and 30,000 kilometres at the end of the year. You drove 20,000 kilometres total. When you add up all the kilometres noted in your logbook, you discover you drove 8,000 kilometres for business. To find the percentage of the time you used your vehicle for your business, divide the business mileage by the total mileage. In this situation, that’s 8,000 divided by 20,000, so you used your vehicle 40% of the time for business.

WOLF RPG Editor is a game construction tool that can create complex role playing games. It is often regarded as being aimed at advanced users, so keep this in mind if you intend to use it. It was developed by SmokingWOLF (SilverSecond) in Japan. I don't have one, but i'm quite intrested in the same thing, I hate using the online save editor because those damn values are a pain in the ass to change when there are usually 7 other values with the same fucking number and you only have like 3 tries to guess which value it is you need to change and which won't just brick your save file. Save file editor f95zone.

As a result, you can write off 40% of eligible vehicle expenses as business expenses. This includes license and registration fees, fuel, insurance, and maintenance repairs. If you lease the vehicle, you can write off the whole cost of the lease, and if you have a loan on the vehicle, you can write off your loan interest. You can’t deduct your principal payments, but you can take a capital cost allowance. To explain how these deductions work, say you spend $1,000 on new tires. Because you use the car 40% of the time for business, you can claim a business expense deduction of $400, or 40% of the cost of the tires.

Pro Tip: Automate logging your mileage by using an auto mileage tracker like QuickBooks Self-Employed.

To find out your business tax deduction amount, multiply your business miles driven by the IRS mileage deduction rate. Let’s say you drove 15,000 miles for business in 2019. Multiply 15,000 by the mileage deduction rate of 58 cents (15,000 X $0.58). You could claim $8,700 for the year using the standard mileage rate method.

Who Needs to Use a Mileage Tracker?

Anyone who uses their vehicle for business should keep a mileage log. Without a mileage log, you can’t claim this valuable deduction. While the CRA considers driving from your home to your office personal use, you are allowed to claim mileage for trips to conventions, going to meet clients, or travelling anywhere else for business.

You can claim the mileage deduction if you’re self-employed, meaning this deduction is available to freelancers, independent contractors, and owners of unincorporated businesses. You can also claim it if you’re a partner in a partnership. In that case, you need to declare these expenses on Line 9943 (other amounts deductible from your share of net partnership income) in Part 6 of Form T2125 (Statement of Business and Professional Income).

Some employed individuals can also claim mileage, and by extension, they should also keep a logbook. To claim mileage as an employee, you need to regularly work away from your employer’s primary place of business. For instance, if you’re a travelling salesperson or news reporter, you may be able to claim mileage expenses. Additionally, to be eligible for this deduction, your employer must require you to cover your motor vehicle expenses. To verify that, your employer needs to complete and sign Form T2200 (Declaration of Conditions of Employment). If your boss reimburses you for your vehicle expenses, you can’t claim mileage.

What Counts as a Deductible Mileage in Canada?

When it comes to mileage tracking for business, the CRA allows you to deduct mileage as part of your business expenses. As stated above there are some rules to follow when trying to figure out when is deductible. Here are some examples of what the CRA considers deductible:

- Trips between offices

- Visits and meals with clients

- Business-related entertainment

- Trips for business travel

- Running errands for your business

- Driving to town to buy office supplies

How to Keep a Mileage Log

You can keep a logbook by jotting down all the relevant information in a paper notebook or saving it in a word processing file, but you may want to use a mileage tracker app to streamline the record-keeping process.

Remember the CRA requires you to keep all business records for at least six years, and that rule also applies to logbooks or data from a mileage tracker app. If you get audited, those details can be essential.

The documentation needed to track mileage includes:

- Your business, commuting, and personal miles

- The business purpose related to the deductible drive

- The mileage (number of kilometres) for each deductible trip

- Dates of your deductible drives, the start location and the destination

To make mileage logging easier for small business owners, the CRA also offers a simplified system. With this system, you must track every single kilometre you drive for work during the first year you use the vehicle for business. That’s considered your base year. You also need to be able to show the percentage you drove the vehicle for business in every quarter of the first year.

In the second year, you need to track your miles for a three-month sample period. To make the process as easy as possible, consider doing this during the first three months of the tax year. During this period, track your total mileage as well as the driving you do for your business. Then, calculate the percentage of the time you used your vehicle for work, and compare that number to the percentage of time you used the vehicle for work during the base year.

To explain, say you used the vehicle for work 40% of the time in the base year. During each quarter, your business usage was as follows: 33%, 45%, 47%, and 35%. During the first three months of the second year, you drove 8,000 kilometres total and logged 4,000 kilometres for business purposes. This means you used your vehicle 50% of the time for business purposes. At this point, you need to plug those numbers into the following equation:

- (Sample Year Period % / Base Year Period %) x Base Year Annual Percentage = Calculate Annual Business Use

Because you used the first quarter of the year as your sample year period, you also need to use the first quarter of the last year as your base year period. As a result, the equation becomes (50% / 33%) x 40% = 61%.

Once you have that number, compare it to the percentage for your base year. If the number is within 10 points, you can use that figure as your annual percentage. In this situation, you used the vehicle 40% of the time for business during the base year and calculated 61% as your potential annual business use percentage. Because the number is more than 10 points away from your base year percentage, you cannot use the simplified system. You have to manually track the numbers for the rest of the year. But, here’s the good news: You can use your second year as a base year and try to move to the simplified system in your third year of business.

On the other hand, if you did all the above calculations and your number is between 30% and 50%, or 10 points lower and 10 points higher than the percentage you used in your base year, you’re allowed to use the simplified system.

If you qualify to use the simplified system, you only have to keep a detailed logbook for the sample quarter as explained above. Then, you just multiply all your allowable vehicle expenses by the simplified percentage. For instance, if you’re using 45% as your simplified percentage, you multiply your expenses by 45%.

Learn how to accurately document your expense with confidence by reading our guide to expenses. Xg editor download.

There’s a Mileage Tracker App!

With the QuickBooks Self-Employed app, you can easily track mileage and get rid of all your cumbersome paper logbooks and be ready for tax time. Track mileage automatically with your phone GPS and categorize trips with a swipe. The self-employed mileage tracking app will also help you track additional transportation business expenses, such as Uber and Lyft trips or plane tickets.

The Benefits of Using a Mileage Tracker App

- Automatic GPS tracking saves battery power

- Organize Expenses

- Saves time

- Accuracy

- Ability to add manual trips

- Data securely stored in the “cloud”

Recording your vehicle mileage helps you with tax deductions and it also helps you separate business and personal trips. This comes in handy during auditing and helps you to determine how much money you spent on business-related travel expenses. Download the QuickBooks Self-Employed app now to automate your mileage tracking while saving time and improving accuracy.

Are you a small business owner who is looking for ways to automate your business processes, such as invoicing and managing bills? 5.6 million customers use QuickBooks. Start tracking your mileage today!